On July 31, 2023 (yesterday) Provenance Gold (PAU.cn) put out this press release regarding one of its drill holes at its Eldorado Project in Oregon:

In what follows I will walk through the content of this news release to give a sense of how I assess drill results more generally.

The first paragraph reads as follows:

The one point of note here is that management emphasizes the fact that the project is in “Eastern” Oregon. Permitting in Oregon is extremely challenging, and likely impossible in the western part of the state. Eastern Oregon is less challenging, and management is clearly emphasizing this, likely having received pushback from prospective investors due to the project being in Oregon.

Details of drill hole ED-07 are provided in the following table.

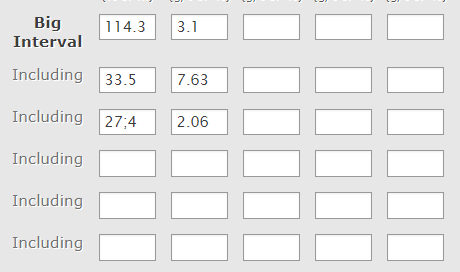

Since there are a couple of higher-grade zones within the large reported intercept I have run these results through the smearing calculator, which can be found here:

There are 2 higher-grade zones here, noting that the 2nd and 3rd “Including’s” are within the first high grade zone. Backing these out to get the grade of the lower grade zones within the intercept we get a grade of 0.8 gpt.

While there is substantial grade variability the residual grade should be economic assuming good metallurgy and open pit mining.

So far so good: this looks like a solid drill intercept. However there are some notable points:

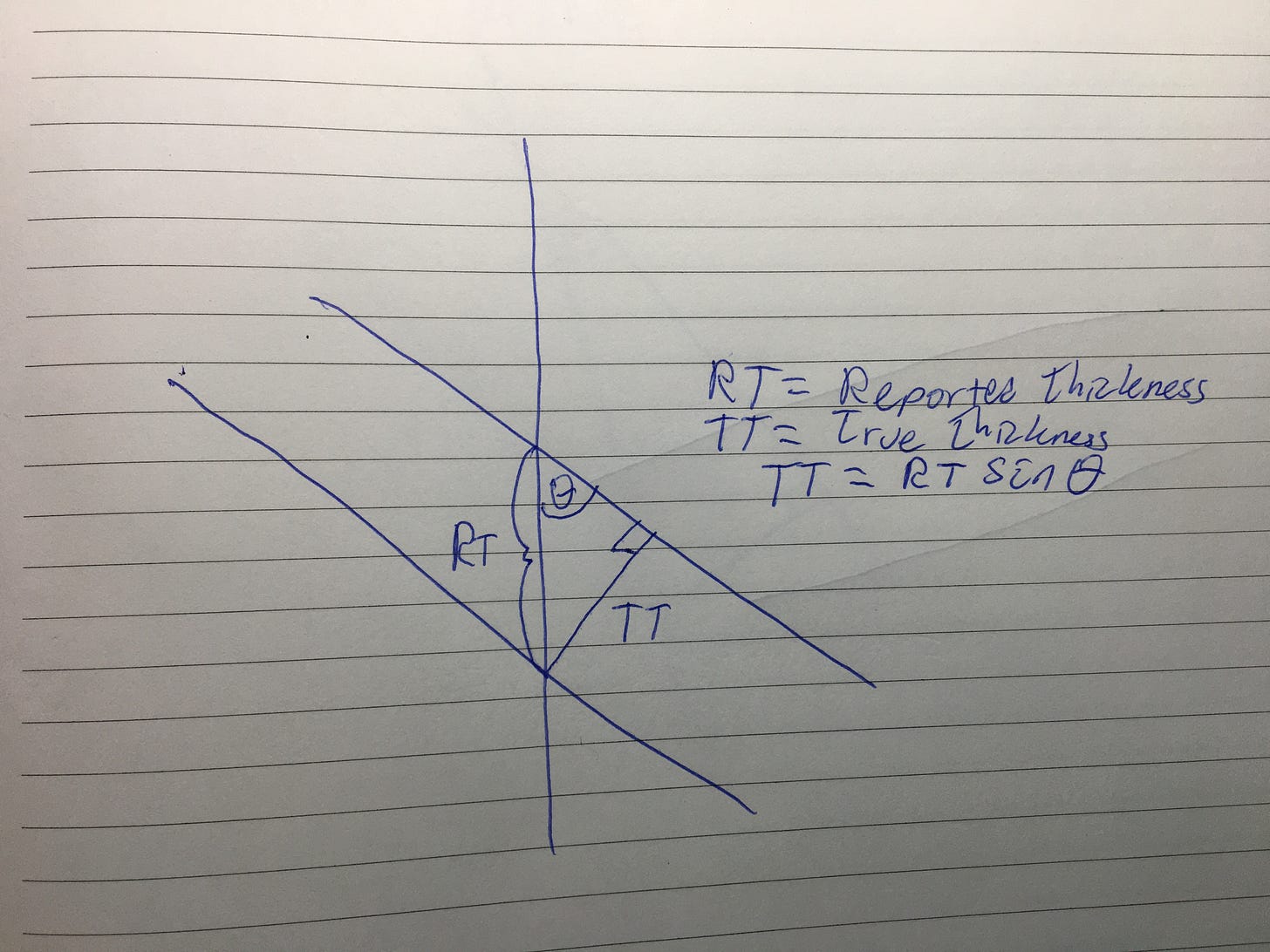

First, the reported interval length(s) is not a true width. Furthermore, there is no reference to true widths. The “true width” of a drill intercept takes into account the fact that the drill hole doesn’t necessarily cut the mineralized structure at a perpendicular. The width of the mineralized structure can be calculated, assuming there is the necessary data, by multiplying the length of the drill hole by the sine of the angle between the dip of the mineralized structure and the dip of the drill hole.

Now we cannot necessarily fault the company for not knowing the true width of the intercept: sometimes there simply isn’t enough data. However, this point is often mentioned by companies in their news releases. There is simply no mention of true widths here, which I find troubling.

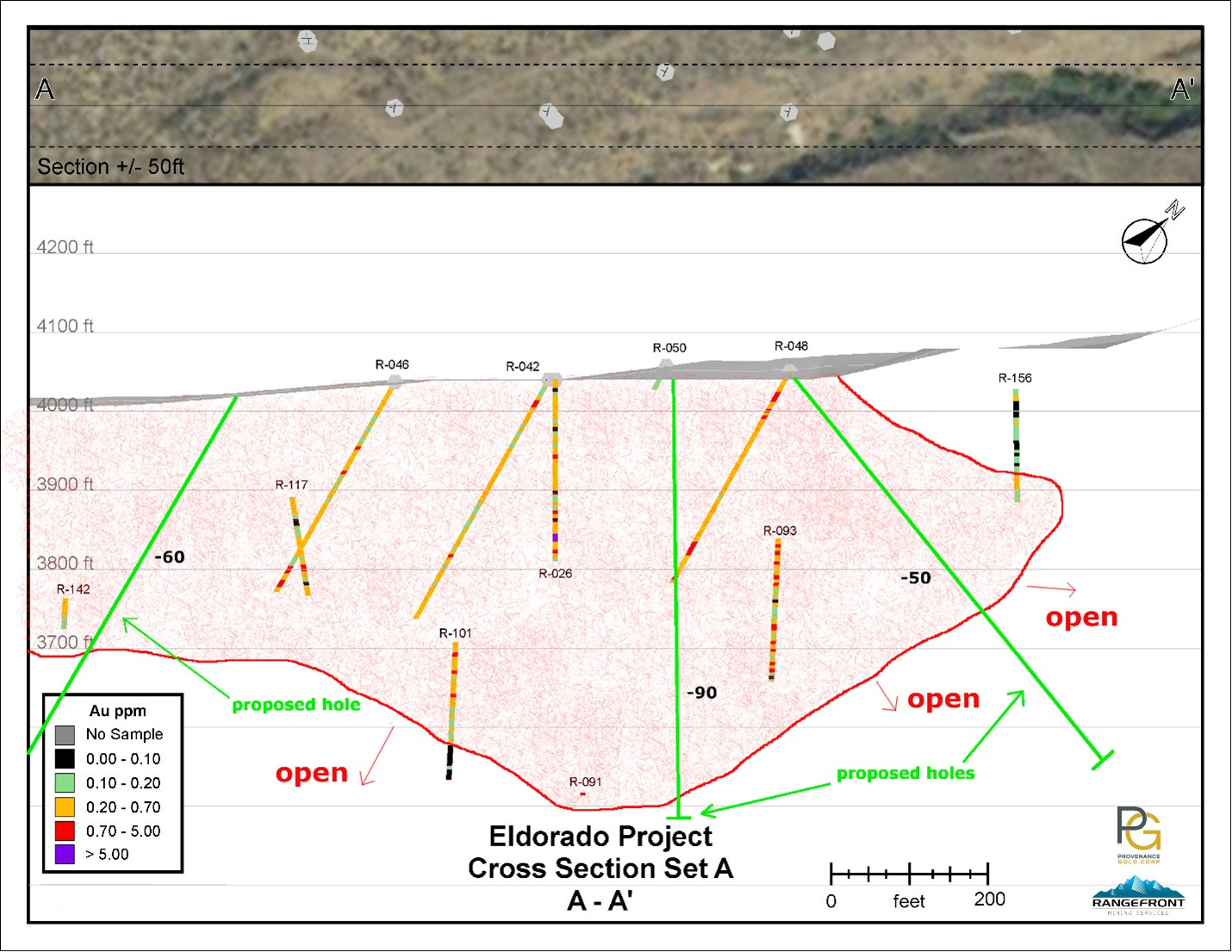

There are also no cross-sections in the NR, which is strange given there are cross sections on the website.

Another issue is that the drill hole appears to be a twin of an historic hole:

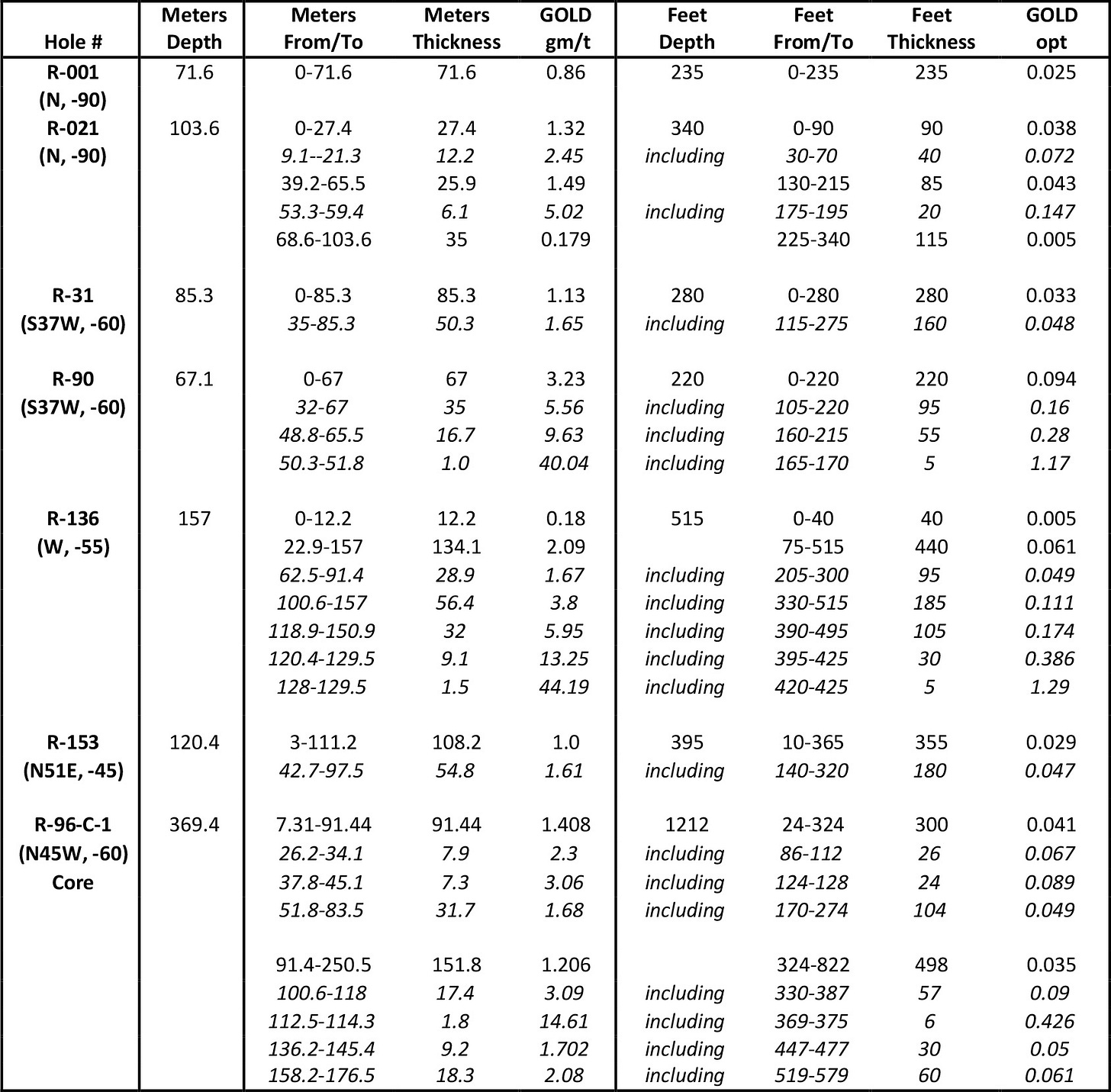

But it gets worse: I cannot find a hole called R-01 in the technical report or on the website, where Provenance does highlight a few historic holes. Based on this table found on the company’s website I suspect it is either R-001 or R-021

Unfortunately, the map of drill hole locations provided in the NR does not provide identification numbers for the historic holes.

The good news is that hole ED-07 is an improvement over both historic holes to which the company may be referring. The bad news is that it is becoming clear that the company is sloppy with its disclosure and how it communicates with the market.

There are a couple of other issues.

First, note in the above comment about ED-07 that the hole ended because the drill encountered water. The company correctly tells us that this will not be an issue for core drilling. What it fails to mention is that a shallow water table could make for challenging mining conditions.

Second, the company has the following to say about two of its other drill holes:

I’m not sure what this means exactly. Were the grades found in these holes too low? What needs to be “further analyzed”? If these holes had hit good results, you’d think management would want to inform the market. Instead, we get more confusion and failure to communicate.

Investor Takeaway

The headline number looks very good. Unfortunately, it is not clear exactly what new information the company has generated. Management fails to communicate this in a clear way. This can only be due to management’s stupidity, or deception. Both are red flags for investors.